Our mission at Central Christian is to be a family that loves God, loves people, and makes disciples of all nations. To accomplish this mission, we rely on the financial sacrifice of the people that call this place their church home. When you give, you enable Central Christian to help its people grow spiritually and share the gospel around the world.

Below you will find several ways to give. Look them over, and choose the option that is best for you. If you have any questions, don’t hesitate to email us.

Faithful Stewards Capital Campaign

Here you can give to the Faithful Stewards campaign. A campaign that focuses on us as a church to be faithful to Him in what he has blessed us with and maintaining it. For more information see Faithful Stewards campaign page.

Below you can set up your pledge, give to your pledge or give directly to the campaign.

Online Giving

Online giving allows you to make secure contributions online. You can give a one-time gift or set up automatically recurring contributions every week or month as you see fit. Set up a secure online account now if you would like this convenience.

Please note, if you choose to set up recurring gifts for any designation, you are responsible for managing that recurrence as you see fit. No end date can be applied to your recurring giving.

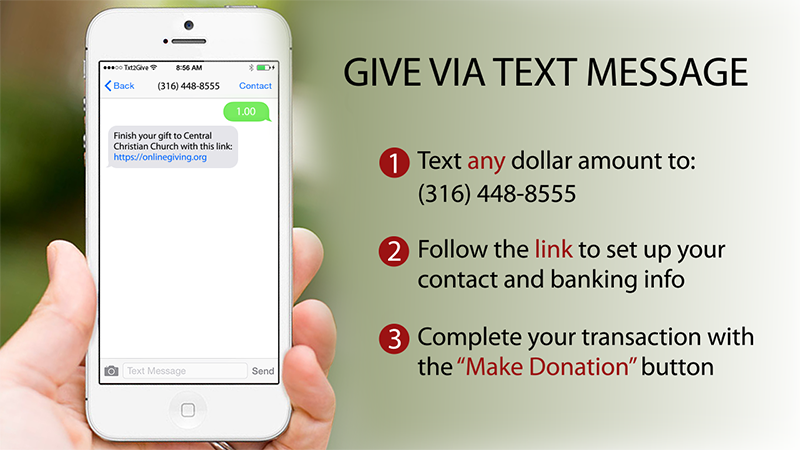

Text to Give

You can give securely via your Mobile Device with just a Text Message (SMS). Once you have made your first donation as shown below, you can give EASILY in the future with a simple Text Message from the same phone number.

NOTE: Save the phone number in your Address Book so it is easy to find later.

How it Works

Tithe/Offering Envelopes

Tithe/Offering Envelopes are also available for secure giving with Cash or Check. These are a dated envelopes with a Donor ID# assigned to you which are mailed to donors bi-monthly. They can be dropped in the offering plates during the service or mailed to the church with the envelope provided.

To be added to this mailing list, please contact Kelly Guthrie, Contributions Manager, at guthriek@ccc.org or (316) 688-4400 Ext. 1404.

Offering During the Service

There are secure boxes at each entrance of the Worship Center where you can drop off your tithes and offerings.

If funds are given with checks containing an accurate name and address, or if giving is done through offering envelopes, the church can track those gifts and issue year-end giving statements. These reports can be used for tax purposes or to track personal giving.

Offering envelopes are available at each entrance to the worship center. You may also request that envelopes be sent to your home.

Contribution Statements

You can access your Contribution Statement for the current year, plus the previous 3 years, anytime by clicking here. You can see Central Christian Church or His Helping Hands statements if you have given to either organization.

You can also opt-in to ‘Go Paperless’ and access your contribution statement online where you can save it as a PDF. We will send out emails in January when statements are finalized.

If you need a contribution statement prior to four years, please contact us.

To access your current year’s giving history click here.

Liquid Securities

Giving appreciated securities such as shares of stock or mutual fund shares instead of cash may be advantageous from a tax standpoint. The advantage to those who itemize their deductions means that they can take a deduction for the current market value of the stock (as of the date of the gift following IRS guidelines) and yet avoid all capital gains tax.

This can make a significant difference depending on the appreciation of the shares during the time you’ve owned it. Consult your tax or financial advisor before making a gift of stock. The church will issue a “Gift in Kind” letter documenting your gift for tax filing purposes.

For questions about these giving options or tax considerations, please contact Kelly Guthrie in the Contributions Office at 316.688.4400.